Online Partnership Firm Registration in India

A partnership firm is a business structure where two or more individuals join forces to carry out a business venture together. It is a popular form of business organization that allows partners to combine their resources, skills, and expertise to achieve common business goals. In a partnership firm, partners share the profits, losses, and responsibilities based on the terms agreed upon in a partnership deed. Partnership firms offer several advantages. They provide a platform for pooling financial resources, which can enhance the firm’s capital and enable larger-scale operations.

Types Of Partnership

Partnership firms can be categorized into two main types: general partnerships and limited liability partnerships (LLPs). Each type has its distinct characteristics and legal implications. Here’s an explanation of both types:

General Partnership: A general partnership is the simplest and most common form of partnership. In this type of partnership, all partners have unlimited liability, meaning they are personally liable for the debts, obligations, and legal actions of the partnership. Each partner has an equal share in the profits, losses, and management of the business, unless stated otherwise in the partnership deed.

Limited Liability Partnership (LLP): A limited liability partnership (LLP) is a relatively newer form of partnership that provides limited liability protection to its partners. LLPs combine the flexibility of a partnership with the benefits of limited liability, similar to a corporation.

Advantages Of Partnership Firms

Shared Decision-making

Partnerships provide a democratic decision-making structure where partners can collectively discuss and decide on important matters concerning the business.

Flexibility

Partnership agreements offer flexibility; this flexibility allows for adaptability in the changing business environment and can facilitate quick decision-making and response to market dynamics.

Tax Benefits

Partnership firms enjoy certain tax benefits. Unlike corporations, partnerships are not subject to double taxation. Instead, the profits and losses of the partnership are “passed through” to the partners, who report them on their individual tax returns.

Confidentiality

Partnership firms often operate with a level of confidentiality. Unlike publicly traded companies, partnerships are not required to disclose extensive financial and operational information to the public.

Easy Formation and Dissolution

Partnership firms are relatively easy to form compared to other business structures. The legal requirements and paperwork involved in establishing a partnership are typically less complex and costly.

Partnership Deed

A partnership deed, also known as a partnership agreement, is a legally binding document that outlines the terms and conditions governing a partnership. It serves as the foundation for the partnership and sets forth the rights, responsibilities, and obligations of the partners involved.

Here are the key components typically included in a partnership deed:

✔ Name and Nature of the Partnership

✔ Duration of Partnership

✔ Capital Contribution and Profit Sharing

✔ Roles and Responsibilities of Partners

✔ Salaries, Interest, and Drawings

✔ Admission and Retirement of Partners

✔ Dispute Resolution

✔ Dissolution and Winding Up

The partnership deed acts as a legally binding document that governs the rights and obligations of the partners and helps prevent potential misunderstandings and conflicts in the future.

Registration Process For Partnership Firms

The registration process for partnership firms involves several steps to legally establish the partnership. Here’s an overview of the typical registration process:

Legal And Compliance Aspects

Legal and compliance aspects are vital considerations for partnership firms to ensure adherence to applicable laws and regulations. Here’s an overview of the key legal and compliance aspects for partnership firms:

Tax Obligations

Privacy and Data Protection

Dissolution And Termination Of Partnership Firm

Dissolution refers to the process of winding up or terminating a partnership firm. Here’s an overview of the dissolution process for a partnership firm:

Notifying Stakeholders

Once the decision to dissolve the partnership is made, partners should notify relevant stakeholders, such as employees, clients, suppliers, and other business associates. This allows them to be aware of the impending closure and make necessary arrangements.

Settling Debts and Obligations

Partners must settle all outstanding debts, liabilities, and financial obligations of the partnership before distributing the remaining assets.

Asset Valuation and Distribution

Partners need to determine the value of the partnership’s assets, including cash, inventory, property, equipment, and any other resources owned by the firm.

Legal Formalities

This may involve filing dissolution documents with the Registrar of Firms or any other relevant government authority as per the local regulations.

losure of Bank Accounts and Cancellation of Licenses

Partners need to close the partnership’s bank accounts and settle any financial matters with financial institutions. Additionally, they should cancel or transfer licenses, permits, or registrations associated with the partnership’s operations.

Mutual Consent and Decision

All partners should discuss and agree upon the dissolution, ensuring that it aligns with the terms and conditions stated in the partnership deed.

Partnership firm vs. Other business structure

When considering starting a business, it’s important to understand the different business structures available and evaluate which one is most suitable for your needs. Here’s a comparison between partnership firms and other common business structures:

Compliance and Regulations

Continuity and Succession

Introduction

A partnership firm is a business structure where two or more individuals join forces to carry out a business venture together. It is a popular form of business organization that allows partners to combine their resources, skills, and expertise to achieve common business goals. In a partnership firm, partners share the profits, losses, and responsibilities based on the terms agreed upon in a partnership deed. Partnership firms offer several advantages. They provide a platform for pooling financial resources, which can enhance the firm’s capital and enable larger-scale operations.

Types Of Partnership

Partnership firms can be categorized into two main types: general partnerships and limited liability partnerships (LLPs). Each type has its distinct characteristics and legal implications. Here’s an explanation of both types:

General Partnership: A general partnership is the simplest and most common form of partnership. In this type of partnership, all partners have unlimited liability, meaning they are personally liable for the debts, obligations, and legal actions of the partnership. Each partner has an equal share in the profits, losses, and management of the business, unless stated otherwise in the partnership deed.

Limited Liability Partnership (LLP): A limited liability partnership (LLP) is a relatively newer form of partnership that provides limited liability protection to its partners. LLPs combine the flexibility of a partnership with the benefits of limited liability, similar to a corporation.

Advantages Of Partnership Firms

- Shared Decision-making: Partnerships provide a democratic decision-making structure where partners can collectively discuss and decide on important matters concerning the business.

- Flexibility: Partnership agreements offer flexibility; this flexibility allows for adaptability in the changing business environment and can facilitate quick decision-making and response to market dynamics.

- Tax Benefits: Partnership firms enjoy certain tax benefits. Unlike corporations, partnerships are not subject to double taxation. Instead, the profits and losses of the partnership are “passed through” to the partners, who report them on their individual tax returns.

- Confidentiality: Partnership firms often operate with a level of confidentiality. Unlike publicly traded companies, partnerships are not required to disclose extensive financial and operational information to the public.

- Easy Formation and Dissolution: Partnership firms are relatively easy to form compared to other business structures. The legal requirements and paperwork involved in establishing a partnership are typically less complex and costly.

Partnership Deed

A partnership deed, also known as a partnership agreement, is a legally binding document that outlines the terms and conditions governing a partnership. It serves as the foundation for the partnership and sets forth the rights, responsibilities, and obligations of the partners involved.

Here are the key components typically included in a partnership deed:

- Name and Nature of the Partnership

- Duration of Partnership

- Capital Contribution and Profit Sharing

- Roles and Responsibilities of Partners

- Salaries, Interest, and Drawings

- Admission and Retirement of Partners

- Dispute Resolution

- Dissolution and Winding Up

The partnership deed acts as a legally binding document that governs the rights and obligations of the partners and helps prevent potential misunderstandings and conflicts in the future.

Registration Process For Partnership Firms

The registration process for partnership firms involves several steps to legally establish the partnership. Here’s an overview of the typical registration process:

- Choose a Business Name: Select a unique and suitable name for your partnership firm.

- Prepare the Partnership Deed: Draft a partnership deed that outlines the rights, responsibilities, profit-sharing ratios, and other terms agreed upon by the partners.

- Obtain Required Documents: Gather the necessary documents for registration, which may include:

- Partnership deed (original and copies)

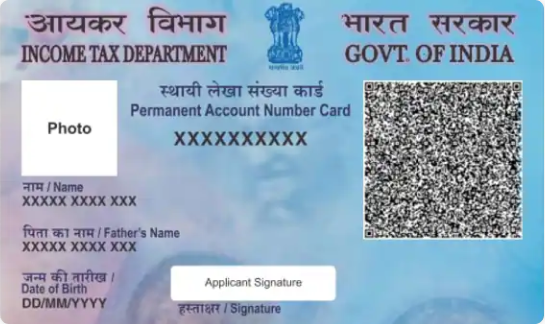

- Identity proof (such as PAN cards, passports, or Aadhaar cards) of all partners

- Address proof (such as voter ID cards, driving licenses, or utility bills) of all partners

- Passport-sized photographs of all partners

- Proof of registered office address (rental agreement, property ownership documents, etc.)

- Visit the Registrar of Firms: Visit the office of the Registrar of Firms in your jurisdiction.

- Pay Registration Fees: Pay the registration fee, which varies based on the capital contribution of the partnership firm.

- Verification and Processing: The Registrar of Firms will examine the submitted documents, verify the details, and process the application for registration.

- Issuance of Certificate of Registration: Once the application is processed and approved, the Registrar of Firms will issue a Certificate of Registration. This certificate serves as proof of the partnership’s existence and legal recognition.

- Obtain PAN and TAN: After receiving the Certificate of Registration, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the partnership firm.

Legal And Compliance Aspects

Legal and compliance aspects are vital considerations for partnership firms to ensure adherence to applicable laws and regulations. Here’s an overview of the key legal and compliance aspects for partnership firms:

Tax Obligations:

Partnership firms are generally required to fulfill tax obligations, including income tax, goods and services tax (GST), and any other applicable taxes It is essential to maintain proper accounting records, prepare financial statements, and comply with tax filing and payment deadlines.

Compliance with Business Regulations:

Depending on the nature of the partnership firm’s activities, there may be specific industry or sector-specific regulations and licenses to comply with.

Intellectual Property Protection:

Partnership firms should take necessary steps to protect their intellectual property rights. This includes trademarks, copyrights, patents, or any other intellectual property associated with the partnership’s products, services, or brand.

Contractual Agreements:

It is essential to review and negotiate contracts carefully, ensuring they align with the partnership’s interests, protect its rights, and comply with legal requirements.

Privacy and Data Protection:

Partnership firms need to comply with data protection and privacy laws, particularly if they handle personal or sensitive information of clients, employees, or other stakeholders. Implement appropriate data protection measures, secure data storage, and comply with applicable privacy regulations to safeguard confidential information.

Dissolution And Termination Of Partnership Firm

Dissolution refers to the process of winding up or terminating a partnership firm. Here’s an overview of the dissolution process for a partnership firm:

Mutual Consent and Decision: All partners should discuss and agree upon the dissolution, ensuring that it aligns with the terms and conditions stated in the partnership deed.

Notifying Stakeholders: Once the decision to dissolve the partnership is made, partners should notify relevant stakeholders, such as employees, clients, suppliers, and other business associates. This allows them to be aware of the impending closure and make necessary arrangements.

Settling Debts and Obligations: Partners must settle all outstanding debts, liabilities, and financial obligations of the partnership before distributing the remaining assets.

Asset Valuation and Distribution: Partners need to determine the value of the partnership’s assets, including cash, inventory, property, equipment, and any other resources owned by the firm.

Legal Formalities: This may involve filing dissolution documents with the Registrar of Firms or any other relevant government authority as per the local regulations.

Closure of Bank Accounts and Cancellation of Licenses: Partners need to close the partnership’s bank accounts and settle any financial matters with financial institutions. Additionally, they should cancel or transfer licenses, permits, or registrations associated with the partnership’s operations.

Notification to Authorities This includes filing final tax returns, settling tax liabilities, and completing any necessary paperwork or formalities.

Partnership firm vs. Other business structure

When considering starting a business, it’s important to understand the different business structures available and evaluate which one is most suitable for your needs. Here’s a comparison between partnership firms and other common business structures:

Sole Proprietorship: A sole proprietorship is the simplest form of business structure, where a single individual owns and operates the business. In contrast, a partnership firm involves two or more individuals who join together to run the business.

Limited Liability Partnership (LLP): An LLP is a hybrid business structure that combines features of a partnership and a corporation. In a partnership firm, partners have unlimited liability, meaning their personal assets can be at risk in case of liabilities.

Compliance and Regulations: Partnership firms typically have fewer compliance requirements compared to private limited companies and LLPs. Companies and LLPs are subject to more stringent regulations and statutory obligations, such as maintaining proper accounting records, conducting annual audits, and filing annual returns.

Taxation: Partnership firms are not taxed as separate entities. Instead, the profits and losses of the partnership are passed through to the partners, who report them on their individual tax returns.

Continuity and Succession: In a partnership firm, the partnership dissolves upon the retirement, death, or withdrawal of a partner, unless otherwise specified in the partnership deed. In contrast, private limited companies and LLPs offer more continuity, as they can continue their operations even with changes in shareholders or partners.

FAQ

What is the minimum number of partners required to form a partnership firm?

A minimum of two partners is required to form a partnership firm.

Are partners personally liable for the debts and liabilities of the firm?

In a general partnership, partners have unlimited liability, meaning they are personally liable for the debts and liabilities of the firm. However, in an LLP, partners have limited liability, and their personal assets are generally protected, except in cases of fraud or wrongful acts.

What are the tax implications for a partnership firm?

Partnership firms are typically taxed as a separate entity, but the income is passed on to the partners, who are then individually taxed based on their share of the profits. Partnerships usually file an annual income tax return, and each partner is required to file their personal income tax return.

Can a partnership firm be converted into a private limited company?

Yes, it is possible to convert a partnership firm into a private limited company. The conversion process usually involves fulfilling certain legal requirements, such as obtaining the necessary approvals and complying with the company registration procedures specific to your jurisdiction.