Register Your One Person Company Online in India

Register your One Person Company online in India with expert support, quick documentation, affordable pricing, and complete legal compliance assistance.

Definition and Concept of OPC

A One Person Company (OPC) is a unique form of business structure that allows a single individual to incorporate and run a company. It provides the benefits of limited liability and separate legal entity status, similar to a Private Limited Company, while enabling entrepreneurs to operate as a sole proprietor. OPCs are designed to support and encourage micro-businesses and solo entrepreneurs to start their own ventures.

Unlike traditional sole proprietorships, OPCs have distinct legal identity and limited liability, which means the sole member’s personal assets are protected in case of business debts or liabilities. The concept of OPC promotes entrepreneurship and provides a suitable framework for small businesses to operate with ease and credibility.

Advantages and Features of OPC

OPCs offer several advantages to entrepreneurs, including:

Eligibility Criteria for OPC Registration

To register as a One Person Company (OPC), certain eligibility criteria must be met. These criteria may vary slightly depending on the specific country’s regulations. Here are some common eligibility requirements:

Natural Person

Only a natural person who is an Indian citizen and resident in the country can form an OPC. Non-resident Indians (NRIs) and persons of Indian origin (PIOs) are also eligible to register an OPC.

Nominee

The sole member must nominate another individual as the nominee for the OPC. The nominee will become the member of the OPC in the event of the sole member’s death or incapacity.

Disqualification

Certain individuals are disqualified from incorporating an OPC. This includes minor individuals, persons of unsound mind, undischarged insolvents, and those who have been convicted of an offense involving moral turpitude or sentenced to imprisonment for a specified period.

No Existing OPC

The sole member should not be a member of another OPC. It is not allowed to have multiple OPCs with the same sole member.

Capital Requirements

There is no minimum capital requirement for OPCs, unlike private limited companies. The OPC can be registered with any amount of authorized capital as deemed suitable by the sole member.

Sole Member

An OPC can have only one member, who will be the sole owner and shareholder of the company. No other person can be a member or shareholder.

Pre-registration Considerations for OPC

Before proceeding with the registration of a One Person Company (OPC), there are several important pre-registration considerations that need to be taken into account. These considerations help ensure a smooth and successful incorporation process. Here are some key points to consider:

Selection of Business Name

Choose a unique and suitable name for the OPC. The name should comply with the naming guidelines. Conduct a thorough search to ensure the availability of the chosen name to avoid any conflicts or rejections during the registration process.

Selection of the Sole Member and Nominee

Select the sole member who will be the owner and shareholder of the OPC

Registered Office Address

Determine the registered office address of the OPC. The registered office is the official address where all communications and notices will be sent. It can be a residential or commercial address, but it must be a physical location within the country of registration.

Compliance with Statutory Requirements

Understand and comply with the statutory requirements and obligations applicable to OPCs. This includes adhering to tax regulations, maintaining proper accounting records, and fulfilling annual filing and compliance requirements.

Professional Guidance

Seek professional advice and guidance from legal experts, chartered accountants, or company registration professionals. They can provide valuable insights and ensure compliance with the specific regulations and requirements.

By considering these pre-registration aspects, you can set a strong foundation for the OPC and facilitate a smoother registration process. It is advisable to consult with professionals or experts familiar with the laws and regulations of the specific country to ensure compliance and a successful incorporation.

Documents Required for OPC Registration:

To register a One Person Company (OPC), certain documents need to be prepared and submitted as part of the registration process. Documents typically required for OPC registration:

Identity and Address Proof of the Sole Member:

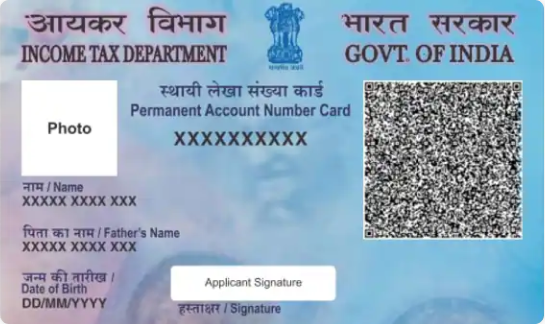

✔ PAN Card

✔ Identity Proof

✔ Address Proof

Nominee Documents:

Identity Proof: Copy of the Aadhaar card, passport, or driver’s license of the nominee. Address Proof: Copy of the Aadhaar card, passport, driver’s license, or recent utility bill (electricity, water, gas) in the name of the nominee. The address proof should not be older than three months.

✔ Passport-sized Photograph

Registered Office Address Proof:

✔ Ownership Proof

✔ Rent Agreement

OPC Registration Process

The registration process for a One Person Company (OPC) involves several steps to establish the company as a separate legal entity. While the specific process may vary based on the country and its regulations, here is a general outline of the OPC registration process:

Obtaining Digital Signature Certificate (DSC)

Apply for a Digital Signature Certificate (DSC) for the sole member and the nominee. DSC serves as an electronic signature and is required for online filing of registration documents. It ensures the authenticity and integrity of the documents.

Drafting Memorandum of Association (MOA) and Articles of Association (AOA)

Prepare the MOA and AOA, which outline the objectives, activities, rules, and regulations of the OPC. Ensure that these documents comply with the applicable laws and regulations.

Filing the Incorporation Application

Prepare and file the incorporation application with Companies Registrar or regulatory authority. The application generally includes the following:

Payment of Registration Fees:

Pay the registration fees as specified by the regulatory authority. The fees may vary based on factors such as authorized capital and the respective country’s fee structure. Payment can usually be made online or through a designated bank branch.

Certificate of Incorporation:

Upon successful verification and approval of the application, the regulatory authority issues the Certificate of Incorporation. This certificate officially establishes the existence of the OPC and provides important details such as the company’s name, registration number, and date of incorporation.

Name Availability Check

Choose a unique name for the OPC and ensure its availability by conducting a name availability check through the respective country’s Companies Registrar or online portal.

Winding Up or Closure of OPC

The winding-up or closure of a One Person Company (OPC) may become necessary due to various reasons such as completion of the company’s objectives, financial difficulties, or the sole member’s decision to cease operations. Here is an overview of the process for winding up or closure of an OPC:

Declaration of Solvency/Insolvency:

Introduction:

Definition and Concept of OPC

A One Person Company (OPC) is a unique form of business structure that allows a single individual to incorporate and run a company. It provides the benefits of limited liability and separate legal entity status, similar to a Private Limited Company, while enabling entrepreneurs to operate as a sole proprietor. OPCs are designed to support and encourage micro-businesses and solo entrepreneurs to start their own ventures.

Unlike traditional sole proprietorships, OPCs have distinct legal identity and limited liability, which means the sole member’s personal assets are protected in case of business debts or liabilities. The concept of OPC promotes entrepreneurship and provides a suitable framework for small businesses to operate with ease and credibility.

Advantages and Features of OPC

OPCs offer several advantages to entrepreneurs, including:

Limited Liability: The liability of the sole member is limited to the extent of their investment in the company. Personal assets are protected from business debts or liabilities.

Separate Legal Entity: OPCs are treated as separate legal entities from their sole members. They can own assets, enter into contracts, and sue or be sued in their own name.

Easy to Incorporate: OPCs can be incorporated with a single member, reducing the complexity of forming a company and avoiding the need for multiple shareholders.

Credibility and Perpetual Existence: OPCs enjoy the benefits of a registered company, such as increased credibility in business transactions and perpetual existence irrespective of changes in the sole member’s ownership or demise.

Business Succession: OPCs provide an option for the sole member to nominate a person who will take over the company in case of their death or incapacitation. This ensures smooth business continuity.

Tax Benefits: OPCs can avail various tax benefits and exemptions provided by the government, promoting the growth of small businesses.

Eligibility Criteria for OPC Registration:

To register as a One Person Company (OPC), certain eligibility criteria must be met. These criteria may vary slightly depending on the specific country’s regulations. Here are some common eligibility requirements:

Sole Member: An OPC can have only one member, who will be the sole owner and shareholder of the company. No other person can be a member or shareholder.

Natural Person: Only a natural person who is an Indian citizen and resident in the country can form an OPC. Non-resident Indians (NRIs) and persons of Indian origin (PIOs) are also eligible to register an OPC.

Nominee: The sole member must nominate another individual as the nominee for the OPC. The nominee will become the member of the OPC in the event of the sole member’s death or incapacity. The nominee should be a natural person and meet the eligibility criteria as mentioned above.

Disqualification: Certain individuals are disqualified from incorporating an OPC. This includes minor individuals, persons of unsound mind, undischarged insolvents, and those who have been convicted of an offense involving moral turpitude or sentenced to imprisonment for a specified period.

No Existing OPC: The sole member should not be a member of another OPC. It is not allowed to have multiple OPCs with the same sole member.

Capital Requirements: There is no minimum capital requirement for OPCs, unlike private limited companies. The OPC can be registered with any amount of authorized capital as deemed suitable by the sole member.

Pre-registration Considerations for OPC

Before proceeding with the registration of a One Person Company (OPC), there are several important pre-registration considerations that need to be taken into account. These considerations help ensure a smooth and successful incorporation process. Here are some key points to consider:

Selection of Business Name: Choose a unique and suitable name for the OPC. The name should comply with the naming guidelines. Conduct a thorough search to ensure the availability of the chosen name to avoid any conflicts or rejections during the registration process.

Selection of the Sole Member and Nominee: Select the sole member who will be the owner and shareholder of the OPC

Registered Office Address: Determine the registered office address of the OPC. The registered office is the official address where all communications and notices will be sent. It can be a residential or commercial address, but it must be a physical location within the country of registration.

Compliance with Statutory Requirements: Understand and comply with the statutory requirements and obligations applicable to OPCs. This includes adhering to tax regulations, maintaining proper accounting records, and fulfilling annual filing and compliance requirements.

Professional Guidance: Seek professional advice and guidance from legal experts, chartered accountants, or company registration professionals. They can provide valuable insights and ensure compliance with the specific regulations and requirements. Professional assistance can help streamline the registration process, minimize errors, and save time and effort.

By considering these pre-registration aspects, you can set a strong foundation for the OPC and facilitate a smoother registration process. It is advisable to consult with professionals or experts familiar with the laws and regulations of the specific country to ensure compliance and a successful incorporation.

Documents Required for OPC Registration:

To register a One Person Company (OPC), certain documents need to be prepared and submitted as part of the registration process. Documents typically required for OPC registration:

Identity and Address Proof of the Sole Member:

PAN Card: Copy of the Permanent Account Number (PAN) card of the sole member.

Identity Proof: Copy of the Aadhaar card, passport, or driver’s license of the sole member.

Address Proof: Copy of the Aadhaar card, passport, driver’s license, or recent utility bill (electricity, water, gas) in the name of the sole member. The address proof should not be older than three months.

Nominee Documents:

Identity Proof: Copy of the Aadhaar card, passport, or driver’s license of the nominee. Address Proof: Copy of the Aadhaar card, passport, driver’s license, or recent utility bill (electricity, water, gas) in the name of the nominee. The address proof should not be older than three months.

Passport-sized Photograph: Recent passport-sized photograph of the nominee.

Registered Office Address Proof:

Ownership Proof: If the registered office is owned by the sole member, documents such as property deed, sale deed, or possession letter need to be provided.

Rent Agreement: If the registered office is taken on rent, a copy of the rent agreement along with rent receipts or utility bills in the name of the landlord may be required. No Objection Certificate (NOC): If the registered office is owned by another person or entity, an NOC from the owner is usually required.

OPC Registration Process

The registration process for a One Person Company (OPC) involves several steps to establish the company as a separate legal entity. While the specific process may vary based on the country and its regulations, here is a general outline of the OPC registration process:

Name Availability Check:

Choose a unique name for the OPC and ensure its availability by conducting a name availability check through the respective country’s Companies Registrar or online portal.

Obtaining Digital Signature Certificate (DSC):

Apply for a Digital Signature Certificate (DSC) for the sole member and the nominee. DSC serves as an electronic signature and is required for online filing of registration documents. It ensures the authenticity and integrity of the documents.

Drafting Memorandum of Association (MOA) and Articles of Association (AOA):

Prepare the MOA and AOA, which outline the objectives, activities, rules, and regulations of the OPC. Ensure that these documents comply with the applicable laws and regulations.

Filing the Incorporation Application:

Prepare and file the incorporation application with Companies Registrar or regulatory authority. The application generally includes the following:

Payment of Registration Fees:

Pay the registration fees as specified by the regulatory authority. The fees may vary based on factors such as authorized capital and the respective country’s fee structure. Payment can usually be made online or through a designated bank branch.

Certificate of Incorporation:

Upon successful verification and approval of the application, the regulatory authority issues the Certificate of Incorporation. This certificate officially establishes the existence of the OPC and provides important details such as the company’s name, registration number, and date of incorporation.

Post-registration Compliance:

After obtaining the Certificate of Incorporation, fulfill the post-registration compliance requirements. This may include opening a bank account, making capital infusion, appointing the first auditor, and complying with statutory and governance obligations.

Winding Up or Closure of OPC

The winding-up or closure of a One Person Company (OPC) may become necessary due to various reasons such as completion of the company’s objectives, financial difficulties, or the sole member’s decision to cease operations. Here is an overview of the process for winding up or closure of an OPC:

Voluntary Winding Up:

The voluntary winding-up of an OPC can be initiated by the sole member. It involves a voluntary decision to wind up the company’s operations and settle its affairs.

Board Resolution:

The sole member must pass a board resolution proposing the voluntary winding up of the OPC. The resolution should be duly recorded in the minutes of the board meeting.

Declaration of Solvency/Insolvency:

If the OPC is solvent, the sole member and the board of directors must make a declaration of solvency stating that the company will be able to pay its debts in full within a specified period. This declaration needs to be filed with the respective country’s regulatory authority.

In the case of insolvency, the OPC must provide necessary documentation to prove insolvency. This may involve the appointment of a licensed insolvency practitioner or a liquidator to handle the winding-up process.

Appointment of Liquidator:

In the case of voluntary winding up, the sole member may appoint a liquidator to oversee the winding-up process. The liquidator is responsible for the realization of assets, settlement of liabilities, and distribution of remaining assets among the stakeholders.

Compliance and Reporting:

The appointed liquidator takes charge of the company’s affairs and performs necessary compliance procedures. This includes notifying creditors, settling debts, filing required documents with the regulatory authorities, and keeping proper accounting records.

Distribution of Assets:

After settling all debts and liabilities, the remaining assets of the OPC are distributed among the stakeholders. This is done in accordance with the priority set out in the applicable laws and regulations.

Removal from Register:

Once the winding-up process is completed, the OPC is officially removed from the register maintained by the respective country’s Companies Registrar or regulatory authority.

FAQ

Can a One Person Company have more than one director?

No, an OPC can have only one director who is also the sole member of the company. This distinguishes it from other business structures like private limited companies, which require a minimum of two directors.

Is it mandatory to have a nominee for an OPC?

Yes, every OPC is required to have a nominee who will take over the OPC in the event of the sole member's death or incapacitation. The nominee must be specified during the registration process.

Are OPCs eligible for tax benefits?

OPCs may be eligible for certain tax benefits and exemptions provided by the government, depending on the specific country's tax laws and regulations. It is advisable to consult with tax professionals or accountants to understand the available tax benefits for OPCs.

Can an OPC have branches or subsidiaries?

Yes, an OPC can have branches or subsidiaries, subject to compliance with the specific regulations and requirements outlined by the respective country's Companies Act or regulatory authority. Each branch or subsidiary may have separate compliance obligations.

Is it necessary to appoint an auditor for an OPC?

Yes, OPCs are required to appoint an auditor within 30 days of incorporation. The appointed auditor is responsible for conducting the audit of the company's financial statements and ensuring compliance with auditing standards.