Filing for income tax return (ITR) may sound complicated but it’s a simple way to report to the government about your income, taxes paid, any type of refunds you want to claim for a financial year (FY).

In India, you earn money during the financial year (FY), which runs from 1 April to 31 March, and after it ends, you file your ITR in the Assessment Year (AR), which is next year. During this period the government checks and assesses the tax on your income that you have already earned.

This blog will revolve around an income tax return filing guide with information such as who should file an ITR, rules that you need to follow, and complete filing steps with ITR online application to file it successfully.

Filing ITR on time will help you stay legally compliant, claim refunds, avoid any further penalties, and maintain a clear financial record.

What is ITR (Income Tax Return) in India?

Income tax return is a form that you file every year to report your total earning, savings, and taxes to the government, so they can check whether you have paid the correct tax and are eligible for refund or not.

Let’s understand what is income tax return with example:

Suppose a Person “A” with an earning of 6-LPA (Lacs per annum). His employer deducts 25,000 as tax. Person “A” also invested 50,000 in tax saving schemes, which reduced his tax. Now after calculating everything while filing for ITR, Person “A” finds that his actual tax should be 20,000. Since 25,000 was already deducted, Person “A” now gets a refund of 5,000.

Who Needs to File an Income Tax Return (ITR) in India?

This applies equally to salaried employees, business owners, freelancers, and professionals living in Guwahati, Assam, or anywhere else in India, as income tax rules are uniform across the country. Individuals earning income from salary, rent, business, or self-employment are required to file an Income Tax Return (ITR) if they meet the prescribed criteria.

Who Must File ITR: Based on Income Limits:

- People below 60 years and have earning of 2.5 lakh (Old Rule) or 7 lakh (New Rule)

- Between 60 – 80 Years (Senior Citizens) income of 2.5 lakh (Old Rule) or 7 lakh (New Rule)

- Above 80 Years (Super Senior) pay of 2.5 lakh (Old Rule) or 7 lakh (New Rule)

Must File ITR Even if the Income Below Limits:

- Foreign travel expenses over 1 lakhs

- Deposit over 1 Crore in current account

- Bill over 1 lakh on electricity

- Turnover of businesses above 60 lakhs

- Capital gains, business incomes, and other special earnings

- NRIs with taxable incomes or high-value transactions in India

Entities Who Must File ITR:

- Firms, Companies, LLPs, Trusts (With few exceptions)

Note: Even if your income is low you still need to file income tax return due to high-value transactions and specific income type to stay compliant.

Benefits of Filing ITR Even if Your Income Is Low

Filing for income tax is useful even if your earning is low because it helps in claiming refunds on taxes, makes a valid tax record, and easier to apply for loans and visas.

Points to notice:

- Filing helps you build a clean and strong financial record.

- It keeps you adaptable with tax laws and avoids any future penalties.

- You can carry forward your business and losses to save tax in the future.

- Claiming refunds if income is still low with certain circumstances.

- Acts as a valid proof of income loans and credit cards.

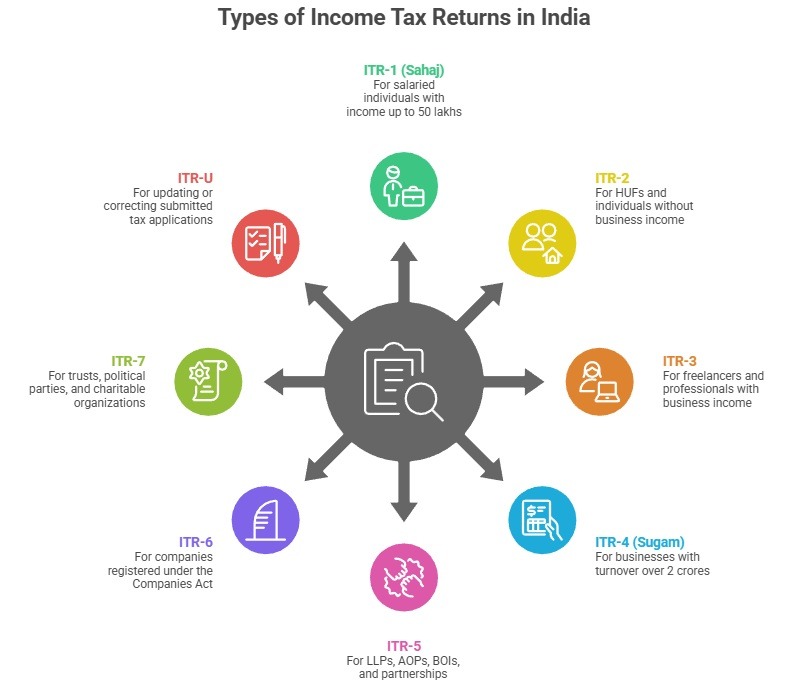

Different Types Of ITR Explained in India

Many wonder how many types of itr filing in India? So let me explain to you in detail about 7 types of itr filing in India and what makes it different from each other.

ITR-1 (Sahaj):

ITR 1 filing is for alaried individuals who are earning an income of up-to 50 lakhs form salary or pension with one property and other source of incomes.

ITR-2:

This one is for Hindu Undivided Families (HUFs) or individuals who do not have any type of business or source of professional income. Use itr 2 filing when your income is more than 50 lakhs, excluding business incomes.

ITR-3:

ITR 3 filing for freelancers, doctors, lawyers, consonants and for Individuals and HUFs who have income from a business or any profession..

ITR-4 (Sugam):

If your business turnover is over 2 crores and professional income is up-to 50 lakhs then ITR 4 filling is for you. This also includes calculating income on a presumptive basis.

ITR-5:

This is for LLPs (limited liabilities partnerships), AOPs (Association of Persons), BOIs (Body of individuals) and partnerships.

ITR-6:

Especially for companies registered under Companies Act. If you run a PVT. LTD. and public limited company this form is for you.

ITR-7:

This form is registered for Trusts, political parties, charitable organizations and institutions. Regular taxpayers no need to fill this form.

ITR-U:

This is used to update or correct the already submitted application for taxes or to file a missed return. (Comes with additional tax and penalties).

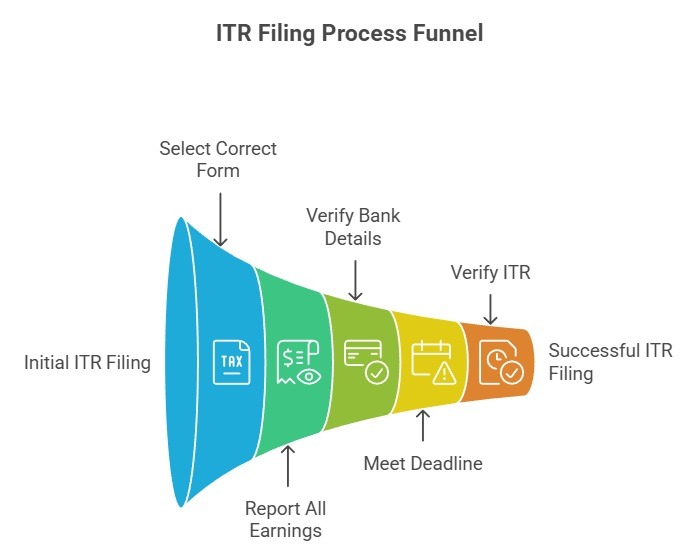

Easy Guide to File ITR Online: (AY 2025-26)

Doing income tax e filing by yourself is now simpler than ever. Follow these 5 online itr filing steps to file without having any issue.

Step 1: Gather Necessary Documents

Before filing the income tax form there are some necessary documents required for income tax return, which are as follows:

- Aadhar card / PAN card

- Form 16 (form your employer)

- Related bank statements

- Form 26AS

- Investment proofs (for deduction under 80C, 80D, etc.)

Step 2: Login on Income Tax Portal

Now register yourself on the income tax portal and begin your application form. If you are a first time applicant then register yourself using a PAN card.

If already resisted, simply login using the credential. Make sure your mobile number and email address are properly updated to get OTP verification.

Step 3: Select The Right ITR Form

In the ITR form filing section Go to “e-File” > “Income tax return”.

- Now choose the correct Assessment Year (AY) followed by (FY 2024-25 = AY 2025-26)

- Select your ITR form, for example (ITR-1 for most of the salaried individuals)

- Moving forward, choose the mode of application online/offline. As in this case online filing is easier for most individuals.

- Fill the complete details carefully including income details, deduction, and tax paid information carefully.

Step 4: Review Using AI-Powered Checks

As systems have advanced these days, applications have become AI-powered. Now the income tax department uses AI-checks to assess your application form.

As users choose the portal in-build ai validation checks for any possible errors in the application form. Verify tax calculation matches what you have paid.

Preview your returns 2-3 times before submitting the form and after submission take a copy of the acknowledgement number for future references.

Step 5: E-Verify Within 30 Days

Review all entered one more time and then submit your form. Now comes the very important part where you have to verify within 30 days of submission using any of the above provided documents like Aadahr, PAN etc.

Once verified, you will receive a confirmation email regarding your verification. Your ITR filing is now completed.

Common Mistakes While Filing ITR: Beginners Focused

Filing for the first time can feel overwhelming, but no need to worry. Please look out for these 9 common mistakes in filing income tax return and you are good to go.

- Selecting Wrong Form Type : Many people pick any random form without checking which is suitable for their type. Check your income source first and then pick the form accordingly.

- Not Reporting Every Earning Source: Forgot to mention interest on saving account, FD (Fix deposit) is a big mistake. The ITR department receives information from banks and clients, so hiding it will not benefit you in any way.

- Filing Incorrect Bank Details: Many often in hurry fill the wrong bank information to claim refunds, filling it wrong and you will not receive the refunds on your taxes, so fill this part very carefully.

- Missing Deadline: The deadline for filing ITR usually falls around July 31st. Missing it may lead to paying penalties and late fees.

- Not Verifying ITR: Filling ITR is not the end. You must verify it within 30 days using the government approved ID card like aadhar. Or you can send a signed copy to their IT department.

- Ignoring Form 26AS And AIS: Form 26AS will show all tax deductions on your behalf. Always verify the form prior to filling.

- Claiming Deduction Without Proof: Claiming dedication (Form 80C) for investment or home loans without actual proof is risky. So keep all records, receipts while claiming.

- Not Keeping a Copy: Always download and save the acknowledgement form (26AS) after the compilation for future references and loan applications.

- Filing in Hurry: The calmly you fill the application less mistakes will happen, so make sure to take your time and fill correct information. Make sure to always cross checks before proceeding to the next step.

Final Thoughts: How to Get Started With ITR Filing

Filing for income tax is very important to contribute to nation-building, additionally it helps you to stay legally compliant and avoid any penalties. I am sure that this blog on how to file income tax return online step by step with complete ITR related information will give you a push to do it by yourself. So make sure to follow this complete guide to avoid any mistakes during filling.

Do you know? Regible Corporate Advisor LLP provides professional ITR filing services in Guwahati, Assam, helping individuals, freelancers, and businesses file their Income Tax Returns accurately and on time. Our experts ensure complete compliance, refund maximization, and hassle-free filing support across Assam and India.

FAQs: Income Tax Return Filing

What is an income tax return in India and who should file it?

ITR means reporting your annual income to the government to check whether you paid the taxes genuinely and are eligible for tax refunds, but it only allows for people whose annual income exceeds 2.5 lakhs in an FY.

How to e-verify ITR using Aadhaar OTP in India?

Login to the official portal of ITR India, go-to “e-verify returns”, select aadhar OTP verification method, enter your aadhar number and verify through the OTP shared on your registered phone number.

What if I miss the income tax filing deadline?

You can file a belated return under 139(4) by 31st December of the AY (Assessment Year), with a penalty of 5000 rs under Section 234F.

Can NRIs file income tax returns in India online?

Yes they can also file online income tax returns in India through the e-filling portal. The condition is you can file it only if you have taxable income in India such as rental, capital gains and more.

What is the due date for filing ITR for FY 2025-26 (AY 2026-27) in India?

The due date for FY 2025-26 (AY 2026-27) is 31st July 2026 for individuals and non-audit cases.

Is Aadhaar-PAN linking mandatory for ITR filing in India?

Yes linking aadhar with PAN is mandatory for income tax filing as per section 139AA. Failure to do so results in PAN becoming inoperative.

What documents are required to file ITR online in India?

Form 16/16A, PAN, Aadhar, Bank Statements, Form 26AS, AIS/TIS, investment proofs, and for deduction form (80C / 80D) and details of income sources.

How can someone verify its ITR after submission?

After submission you have 30 days of time to verify your ITR through any of the provided methods such as Aadhar verification, net banking, bank ATM and more.

What is Form 26AS and AIS in income tax filing in India?

Form 26AS is your annual tax credit statement while AIS is an annual information statement that shows all your financial transactions reported.

How to claim income tax refund in India?

File your ITR with correct income details, e-verify it, and the refund will be automatically processed to your linked bank account within 20 to 45 days.

Can I hire a professional to File my ITR in Guwahati Assam?

Yes, you can hire a professional tax practitioner firm like Regible Corporate Advisor LLP to file your ITR, especially if you have complex income sources. Contact Them Now.